124

Section C

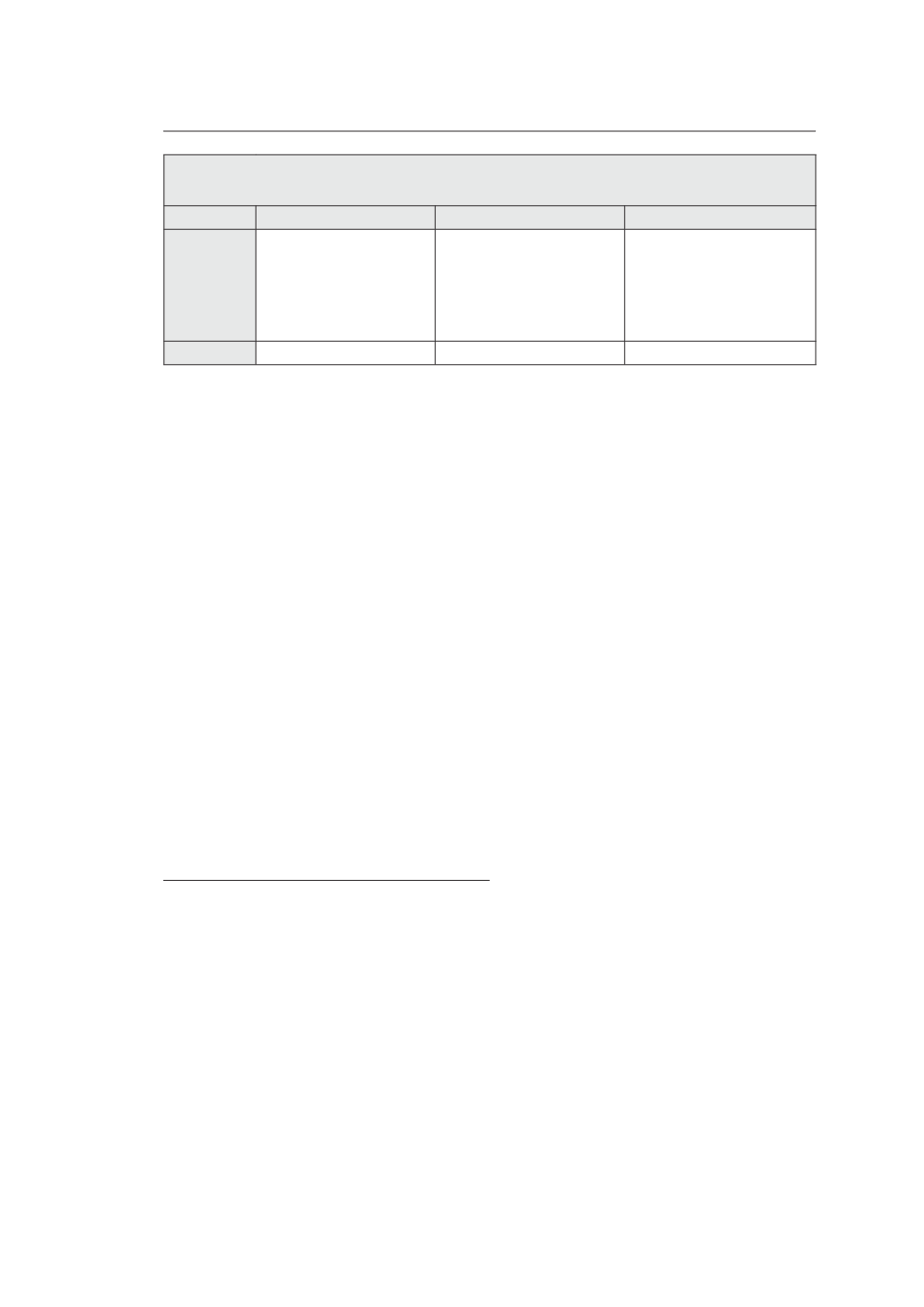

TABLE 13

A comparison: ECB (as a supervisory authority), EBA and ESRB

ECB

EBA

ESRB

Tasks

micro-prudential

supervision of credit

institutions (SSM

Regulation, Articles 4

and 5)

various (EBA

Regulation, Articles

8-9), but

not a

supervisory authority

macro-prudential

oversight of the

Ànancial system (ESRB

Regulation, Article 3,

paragraph 1)

Seat

Frankfurt

London

Frankfurt

5. Creation of ‘Chinese walls’

5.1 Introductory remarks

Although the safeguarding of Ànancial stability has historically been a major

objective of central banks and the micro-prudential supervision over credit in-

stitutions a main competence and task thereof (with the exception of a few

central European countries), an ever increasing number of countries around

the world have assigned this supervision since the 1980s to independent au-

thorities other than the central bank.

462

The rationale behind this development

was that the exercise of supervisory powers by the central bank may give rise

to conÁicts of interest that would undermine the efÀcient achievement of its

monetary policy objectives (not least in terms of maintaining price stability).

463

However, this trend has tended to be reversed in the aftermath of the recent

(2007-2009) international Ànancial crisis as a result of the relevant failures at-

tributed to independent supervisory authorities in many states all over the

world.

464

In addition to the Bank of England since 1 April 2013,

465

the ECB has

462. See on this indicatively

Herring and Carmassi (2008)

, with extensive further referenc-

es, and

Central Bank Governance Group (2011)

. On the trend towards integrating sec-

toral Ànancial supervisory authorities (for banking, capital markets and insurance/rein-

surance) into a single body, see

Hadjiemmanuil (2004)

,

Wymeersch (2006)

(speciÀcally

in Europe),

Filipova (2007)

,

Group of Thirty (2008)

, and

Seelig and Novoa (2009)

.

463. For an overview of the debate on whether it is appropriate for a central bank, as a

monetary authority, to also perform micro-prudential banking supervision tasks (‘sepa-

ration of monetary and supervisory tasks of central banks’), see the seminal paper by

Goodhart and Schoenmaker (1993)

, as well as

Haubrich (1996)

,

Di Noia and Di Gior-

gio (1999)

,

Goodhart (2000)

,

Gianviti (2010)

, pp. 480-482 and

Beck and Gros (2013)

.

464. See

Davies and Green (2010)

, pp. 187-213.

465. Under the UK Financial Services Act 2012, the Prudential Regulation Authority (‘PRA’)

was established as a subsidiary of the Bank of England, responsible for the micro-pru-

dential supervision of banks, building societies and credit unions, insurers and major